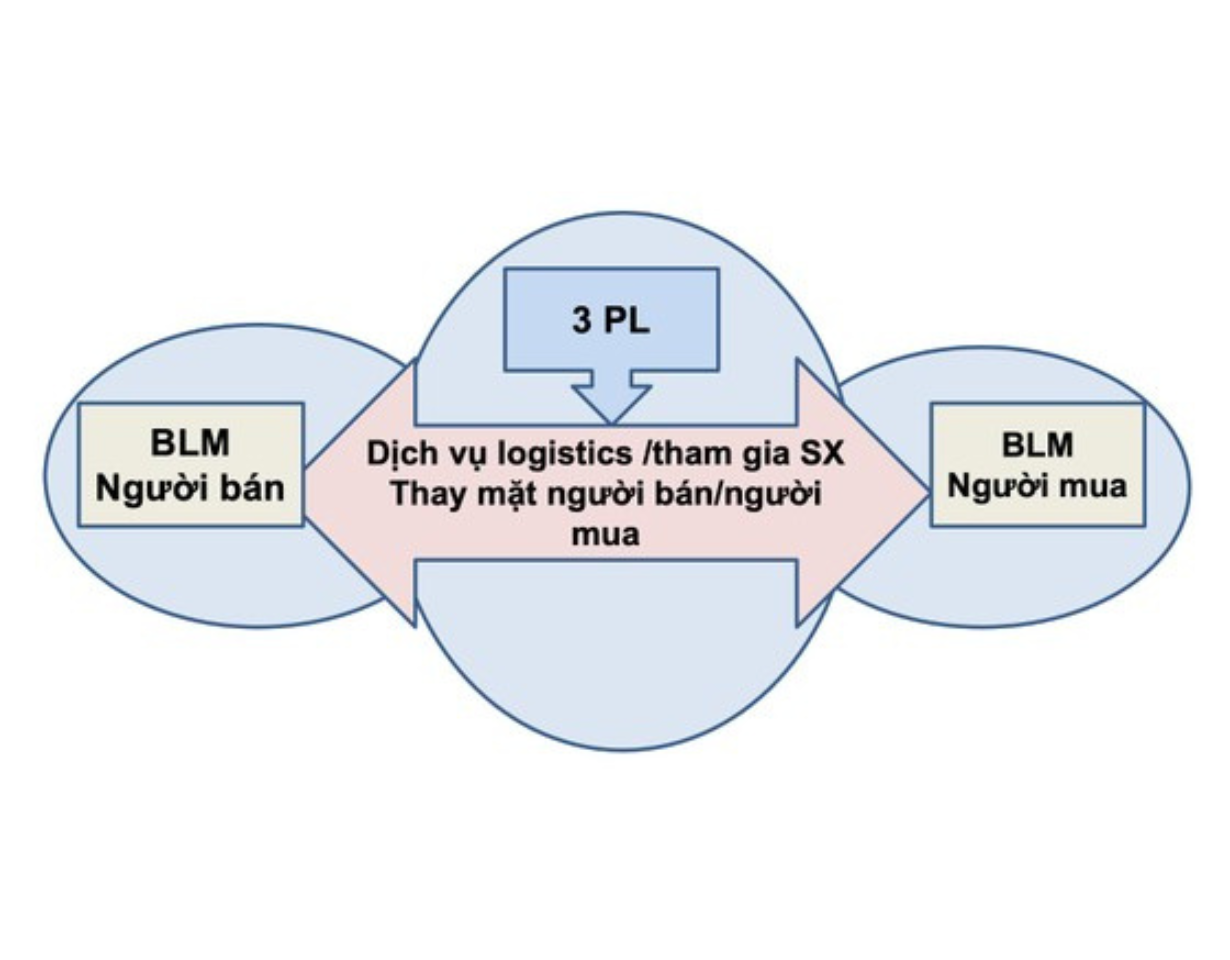

Logistics businesses need to aim to provide 3PL services

The global logistics industry is moving towards a 3PL model that provides transportation, warehousing, and additional value-added services such as inventory management, picking, packaging, and order tracking. However, most domestic enterprises currently only provide self-sufficient logistics services (1PL) or provide 2nd party logistics services (2PL).

Businesses have not taken advantage of opportunities

Vietnam is one of the fastest-growing logistics countries in the world, which is expected to continue growing for many years to come, thanks to the growth in the high-tech manufacturing sector and the increase in the middle class. Vietnam's logistics service industry includes domestic and foreign companies.

However, the companies hardly do international shipping business, except for handling and transporting goods by road across the northern border with China (accounting for only a small portion of goods entering and leaving Vietnam).

The industry's biggest challenge is the quality and reliability of services. But these problems can be solved by learning experiences from other markets.

To analyze the investment opportunities in this sector, we divide them into high-investment segments, low-investment segments, concentrated segments, and distributed segments. Currently, the domestic logistics service industry consists mainly of companies from micro to small, so it needs a lot of capital to operate in the highly fragmented segment.

For example, trucking companies account for about two-thirds of all businesses in the industry, but more than 80% of trucking companies have fleet sizes of less than 5 vehicles, and an estimated 70% of delivery trucks Return to the station with empty tanks.

Therefore, the intermediary that is paid a commission accounting for about 30% of the service fee is too high (in cold storage transport - one of the most promising segments of Vietnam's logistics industry, the majority of the market share belongs to the logistics industry foreign-invested companies with about 70%).

The opportunity is still ahead

In our view, the opportunity is very attractive for domestic companies, stemming from the fact that foreign customers are willing to pay high prices for reliable logistics services. Moreover, the demand of middle-class customers for high-quality logistics-demanding products and services is growing rapidly.

For example, online shopping with home delivery, and demand for perishable food and medicine. Because companies in the logistics sector with sufficient scale and professional management will benefit from reduced costs over time, as infrastructure in Vietnam and other issues will be improved.

We also expect an attractive return on investment for logistics companies benefiting from increased high-tech manufacturing, as well as from the growth of the middle class in Vietnam.

The development of the high-tech manufacturing industry has led to increased demand for high-value logistics services, such as bonded warehouses for the concentration of relatively high-value goods (compared to apparel and footwear slippers) before such products are exported.

In addition, machinery imported to produce consumer electronics is often of high value. As a result, customs clearance and freight forwarding operations require more precision and processing techniques than textile and yarn equipment for garment production.

In addition, the logistics industry has grown by 14-16% in recent years, and the total cost of logistics services in Vietnam is more than 20%/GDP, among the highest in the world. For example, three-quarters of Vietnam's cargo volume passes through only six of the country's 75 seaports.

This presents an attractive opportunity for private equity funds and other investors that can help local businesses grow in revenue and profit, by applying international best practices.

Towards 3PL service

High-quality logistics is now essential to handling high-value consumer electronics, but logistics costs represent just over 1% of the price of such items (compared to around 30% for agricultural products such as rice).

With high requirements for service quality, coupled with modest logistics costs in the total costs of consumer electronics manufacturers, it will allow logistics service companies to charge higher service fees, if they meet the requirements and meet the needs of these demanding customers with the provision of 3PL logistics services.

We see three potential investment strategies:

1) Invest in leading logistics companies to develop integrated platforms that can provide customers with a cost advantage.

2) Identify specific assets that need capital to upgrade or can be reused and accelerate growth by increasing operational efficiency.

3) Mergers and acquisitions.

The adoption of international best practices - such as digitization, along with capital raising is important to these strategies. In, capital injection is necessary, if the investor's strategy is to increase the company's capacity by adding trucks to a trucking company or invest in more cranes/heavy equipment for enterprises operating in warehouses and ports.

An attractive branch in Vietnam's logistics industry is customs clearance services. In particular, a well-qualified intermediary can accelerate the clearance of goods at home and abroad, by ensuring compliance with the complex regulations required.

According to the Vietnam Logistics Business Association (VLBA), more than 800 Vietnamese freight forwarding companies provide customs clearance services. However, we believe that companies can incorporate customs clearance services as part of the “Core Transport Enterprise” criterion, which is capable of meeting the transportation/logistics needs of companies high-tech production to obtain higher service fees.

Related Posts

New Posts

- INDEPENDENCE DAY HOLIDAY ANNOUCEMENT

- PPL Teambuilding 2024: Uniting Our Strength, Igniting Success!

- Charity Program Warms Hearts Of PPL in Phuoc Hai Town

- Vietnam Holiday Announcement

- PPL contributes to the success of the Greater Changhua 2b&4 Offshore Wind Farm Project

- Update on the Nam San 3 (Laos) Project February 2024

Comments